Being frugal when it’s just you, or just you and a significant other, is pretty simple. Trying to live that lifestyle with little humans running around proves a little more difficult.

However, it is not as difficult as it may seem.

We trade a lot of money, for just a little more convenience, way too often, and we trade a lot of money for things that our kids don’t really need.

That money adds up into a decent chunk of cash that could have been used to pay off debt, go towards college, go towards retirement, or even towards a family vacation. When you’re trying to make a lifestyle change towards being more frugal, or living a simpler life, you have to look ahead to the future and ask yourself what you want it to look like.

If you want it to look like early retirement, being able to pay for college for your kids, being able to travel or go on missions trips, investing in real estate, or maybe even being able to afford for one parent to stay home with the kids and not work. Whatever your dream may be, that is what you need to focus on.

Every time you feel the urge to impulse buy that cute little dinosaur stuffed animal for your child who has been good all day, think about what you want your future to look like, explain that to your children in words they can understand, and read these helpful tips on how to be frugal when you have kids, so that you can learn alternative options to try instead!

1. Just say no to buying toys as rewards for being good. (at least most of the time)

I’m not judging here. This used to be me!

My daughter would be so good the whole time I was on one of my weekly shopping excursions, and I would see something that was stupid adorable… (I’m a sucker for stuffed animals and so is my daughter) and I’d surprise her by grabbing it, handing it to her, and telling her that the stuffed animal needed a mommy to love her. She’d get a huge smile across her face, and her day (and mine) would be totally made.

It makes you feel good to treat your child. I understand that completely, but even if you only do it occasionally, it can soon backfire and turn into this scenario every time you go shopping:

“Mommy, can I get a toy? I’m being good! Can I have that stuffed animal? Can I have that car? Can we go look at the other toys? I want a coloring book! Please, please, pleeeeease!!”

You totally know what I’m talking about right?…

It gets old really fast and soon enough it can turn into a power struggle every time you need to go to the store.

It is very difficult for children to understand why sometimes they get a toy when they are good, and sometimes they don’t. They will start whining and asking why, and then their behavior while shopping goes from good to not so good in an instant.

This was beginning to happen when I took my daughter shopping with me, and I knew I had to put a stop to it. Not only because begging was not a habit that I wanted my daughter to acquire, but also because I realized she didn’t need more toys, and simply put, it was a waste of money.

Kids can learn to behave without receiving a toy in return. Just a simple, “I am so proud of you for being so good today. I really liked the way you sat quietly in the cart! You are really growing up!” will put the same smile on your child’s face, (with a boost to their self-esteem as well) be easier on the wallet, and will also make for less clutter in your home!

A Positive Reward System

If you like the idea of a reward system, then try making a sticker chart.

Every time your child behaves in public, let them put a sticker on the chart when they get home. Once they have received a certain number of stickers for the week, (or the month) treat them to an experience.

This does not have to cost money.

Most kids are VERY easy to please. For a two or three-year-old, this can be as simple as going to their favorite playground or having a movie night with mommy and daddy while eating popcorn, or helping mom (or dad) bake a special treat and getting to eat an extra piece of said special treat when you’re done! For an older child, try planning a fishing trip, or a family hike, or a trip to a farm if your child loves animals.

As parents, we tend to think these simple activities won’t make our kids as happy, because we may do these things with them already, but in reality, it overjoys them. They love any kind of opportunity to spend time with you. That’s all kids really want. Time with us, and our undivided attention and love.

IF however, your child’s love language is receiving gifts, than it may not be a bad idea to have them earn some kind of small gift with their sticker chart. But again, this doesn’t have to be expensive! It can be a simple dollar store item, or even something handmade from you. It does not have to be (and shouldn’t be) barbie’s dream house every time they meet the sticker chart requirements. 😉

*Side Note – If you haven’t read the book “The Five Love Languages of Children” yet, I HIGHLY recommend that you DO. It’s just such a good read, and incredibly helpful for learning to love your child in the way that they feel love the most. Check it out HERE.

2. Paper Towel Alternative

Kids. Are. Messy.

I will probably always have paper towels in my home… There are times when a mess is just too messy and it’s the best way to go. (for me)

But I also think that they are way overused.

If you haven’t heard of Norwex cleaning products, you really should check them out! My favorite product is the Envirocloth. It is a micro fiber cloth that is chemical free, cleans incredibly well, and the best part is that you can wash and reuse them! They can be used for just about everything, and they can last for seven years or longer if you care for them properly.

This will save you money not only on paper towels, but on cleaning sprays as well because; here is the other awesome part about these cloths, you don’t need ANY sprays or cleaning chemicals to use them… HUGE BONUS!

Norwex products have largely contributed to decreasing cleaning expenses in our family budget, AND the chemical use in our home.

Here’s the breakdown:

Paper towels are roughly 3.6 cents per square foot, or 2.7 cents per sheet. I’ll use my family’s size as an example. (family of four – two adults, two young MESSY children)

Let’s say I use paper towels for all my clean ups. (which I admittedly used them WAY too much before) After 3 meals, 2 snacks, 2 messes (of spilled milk on the floor and who knows what else!) 2 times of drying your hands after doing dishes, and wiping down counter tops… I think it’s safe to say you could easily use 12 sheets a day (and probably more) if that’s what you use for most of your cleaning. Plus add in regular window and mirror cleaning, lets estimate that adds an average of one more sheet per day. (I am not including the really yucky messes that I still use paper towels for… think potty training accidents, and a dog getting sick in the house… sorry but I just can’t…. I need my paper towels still for things like that!)

So let’s go with the number 13 sheets per day for a family of four. That equals out to 35 cents per day, which equals $10.50 per month.

One envirocloth is $18 and it can last for 7 years. That means in those 7 years you could save $882 just on paper towels. That’s not even including how much you will save on sprays and cleaning chemicals!

It may not sound like a lot, but if it’s one piece to your entire puzzle of savings, trust me, it adds up.

Not to mention this is a MUCH greener alternative.

Not only are you saying goodbye to harmful chemicals in your home but take a look at these numbers:

If every household in the U.S. used just ONE less 70 sheet roll of paper towels in a year, that would save 544,000 trees. Taking it further… If every household in the U.S. used THREE fewer rolls per year, it would save 120,000 tons of waste that piles up on our planet, and it’d save $4.1 MILLION in landfill dumping fees…

Those are BIG numbers guys… So while we are saving money, we can also help save our planet, and save our country money as well… bam…triple bonus.

Have I convinced you to try out Norwex yet?? I hope I have! 🙂

There are many more products available than just the cloths that I talked about too.

To check out all their products, CLICK HERE. – By the way, I am not a consultant, I literally just love these things!

I have also used E-cloths that I bought off Amazon recently that I have been quite happy with as well, and you get a little bit more for your money if you get this starter kit.

3. Accept hand-me-down clothes from family/friends or buy secondhand.

I know, I know… It is ridiculously hard to resist that tiny little sweater with a fox peeking out of the pocket, staring at you in Target, just begging you to take it home and put it on your adorable tiny human.

Guess what, I don’t even try to force myself to resist ALL the time.

Growing and birthing a baby is a lot of fricken work, and if I want to buy a brand new, adorable fox sweater for my little ones once in a while (and the budget allows for it) then gosh darn it, I’m gonna do it….

BUT, you do not need to buy all brand new clothes for your child’s entire wardrobe. (as much as we all wish we could right??)

Kids grow out of things super fast, so a lot of times you can find very gently used clothing at secondhand stores, or from friends looking to pass their kid’s clothing down. Sometimes even yard sales can be gold mines!! I actually have a blast searching for cheaper, but still super cute kids’ clothes. It’s a fun challenge that I am always willing to take, and it saves me money too! 🙂

Parents also tend to buy way more clothes than what is necessary for their children. When looking at a new piece of clothing for your child, ask yourself this question. “Am I buying this sweater because my child needs it, or am I buying this because it is adorable even though my daughter already has five perfectly good sweaters in her closet.”

Remember we are trying to focus on the big picture here. A little savings every month now, adds up to big savings for the future!

Another good idea to stock up on kids’ clothes, while also minimizing the toy clutter, is asking family for the next size up in clothing that your child will soon need for Christmas and Birthdays (instead of more toys) and be specific about the needs. Ask one family member to get the next size up in socks and undies, and another family member to get the next size up jammies, etc! That way you won’t end up with a bunch of dresses or T-shirts in the next size, but lacking in everything else that is needed.

Doing this will give you a great head start once they out-grow the size they are currently in.

*Side Note – Don’t forget to give back! Go through your children’s clothes every season and give in the same way that people may have given to you! Hand clothes down to others in need, while at the same time removing clutter, and clothes that are no longer used from you children’s closets.

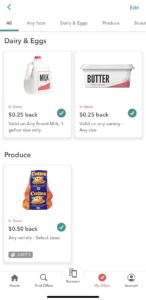

4. Use the Ibotta App to save money on every-day purchases!

Ok, so I am pretty crazy about this one, because it really has helped us save a lot on purchases, especially on groceries!

Ok, so I am pretty crazy about this one, because it really has helped us save a lot on purchases, especially on groceries!

This app gives you rebates on every-day purchases from TONS of different stores, and all you have to do is claim the “deal” or rebate that you want to use, and then scan your receipt into the app after you purchase it! The money will show up in your account within 24 hours and once you reach the $20 threshold you can either cash out by sending it directly to your pay pal account, use it on one of the gift card options that they have available to you, or just continue to save up within the app until you are ready to do one of those things!

The app also allows you to make additional money in different ways when you are on a team, and you can help each other reach goals to earn more $$$!! It costs zero dollars to join or have an account and you can start saving right away. 🙂

I saved about $40 my first year after signing up for Ibotta, and I signed up towards the end of the year, so it was only 3-4 months worth of using the app!

If you’d like to try ibotta and earn a $10 start up bonus just for signing up with my link, Click here!

Ibotta is super simple to use and takes hardly any time. It is modern day couponing without all the clipping, and it is SO good.

You can read my full review on the Ibotta App HERE.

5. Limit eating out as much as possible.

This is the hardest one in my opinion… Sometimes it is just way more convenient to hit a fast food drive through while you’re out and about running errands with the kids.

I’ve been there and I get it!

But you would be absolutely amazed at how much you can save if you just pack them (and yourself) a sandwich and some snacks for those trips instead.

Plan ahead on the days you want to go out and pack a little lunch pail with goodies for everyone. Put one really yummy item in there so that you’re excited for your lunch.

If you and your husband work outside of the home, try to pack lunches for your work days as well. This will not only save you a ton of money, but it will be healthier for everyone!

I use these containers to pack our lunches. I love how they have separate sections, and my kids think they are the bomb.com too. (Oh, to be so easily entertained, right?)

I’m not trying to ruin all your fun by telling you to never eat out ever. But instead of having it be a frequent event, turn it into something that is only for special occasions. Like a date night for you and your significant other, or a family get together, or a once a month breakfast out. Set a budget for eating out each month and STICK TO IT.

Moderation is key!

6. When looking for baby gear, or even diapers, check your local Facebook sales groups first!

You’d be amazed at the amount of baby stuff sold on Facebook marketplace and other Facebook sales groups. I sometimes even find unopened boxes of diapers for up to $15 cheaper than what you would buy them for at the store! Now that’s a deal.

I know most of us don’t have time to be driving around town picking up everything from people off of Facebook, but big-ticket items can often be found for really great deals!

A few years ago, I purchased a hardly used, like-new baby swing for my son off of Facebook Market for $50. The same swing retails for $120.00 in stores and online. It worked great, had no stains or odors, and I was super happy that I saved $70. Plus, when you get things for great prices like that, you can almost always sell them for the same price again when you are finished with the items, so long as you keep them in good shape! (I did!)

Advertisements can make us feel like we need the newest, trendiest, most expensive things out there for our babies, but the truth is that most babies don’t even like all those gadgets, and they mostly want to be held.

So, save your pennies, and if you think you need a swing or a bassinet… Check Facebook sales first.

Side Note: (I do not recommend buying car seats, or other baby items that could pose a safety risk, or possibly be expired from Facebook.)

The swing that I got off Facebook Marketplace with my little sweetie sitting in it!

The numbers…

So let’s go back through the list and come up with some quick numbers of just how much you could be saving in a year if you start applying these tips to your life now.

I am going to show you numbers based on what our budget looked like before we made these changes, and what it looks like now that we have started implementing them.

You, of course, will have to adjust these numbers accordingly based on what you spend on average in these areas.

- Before we made these changes to our budget, I was spending an average of $15 per month on little gifts here and there for Honor when she was behaving in stores. This does not include gifts for holidays or her birthday. Just extra little gifts here and there for being good or just because. It wasn’t a lot, but even the little things you cut out can add up.

- I still use paper towels, but not nearly as often, so I am saving about $10 a month on them.

- Now that I buy more second-hand clothing and receive some hand-me-downs, I am saving, on average, about $25 a month on clothing for my kids. (would be more, but I do still buy some new items, just for fun)

- We saved $40 our first year using the Ibotta app. If you use it consistently, you could easily save at least $120 a year, with the opportunity to earn more if you wanted to!

- My husband and I have recently lowered our eating out budget down by $35 a month. We’re trying hard to use our budget mostly for special occasions and not for convenience.

- I bought two items through Facebook marketplace last year that I needed for my kids. Both of those added up to $105 in savings (which is the extra amount I would have spent if I bought them brand new.) and I was able to re-sell them later for the same price that I purchased them at, which ended up making me another $85 dollars. So, we will make it $190 in savings.

Guys…. this all adds up to a grand total of $1,330 per year!!! I hope I am not the only one excited about this!

Think about what you could do with this money. If you put it into a savings account that gave you some interest on your money, and you continue to put $1,330 into it every year, it will grow to over $23,000 in the span of 18 years. (You can keep applying these same money saving tips with older kids too!) $23,000 is a nice chunk of change to go towards college, retirement, paying off a mortgage, invest it and make your money work FOR YOU for a change, or, use the money towards a vacation and treat yo-self! 😉

There are a lot of other ways you can save money with kids. These are just some areas that my husband and I have been focusing on the past few years, and we’re beginning to see the benefits from it!

I know the transition into frugality, and away from impulse buying isn’t always an easy one. If it feels hard for you, start with doing just one of these things I mentioned in this post and ease yourself into the process slowly. If you try to cut back on everything at once you may feel overwhelmed and even deprived.

Start slow, be intentional with your purchases, and enjoy watching the savings build up. Soon it will encourage you to expand the amount you save, and you will be able to conquer the things on this list and more!

Why we work hard to save.

My husband and I are doing these things, not because we love money, or because we want to acquire some obscene amount of it just because. Our goal in this is to say no to consumerism, spend our money on things our family needs, and invest it wisely.

We want to be prepared, free from financial burdens, able to help others in need, and able to chase our dreams! If that sounds like the kind of life you’d like to have too, then I am glad you found this blog, and I hope you’ll poke around a bit.

…and now for your inspirational, money saving, quote of the day…

- “I love money. I love everything about it. I bought some pretty good stuff. Got me a $300 pair of socks. Got a fur sink. An electric dog polisher. A gasoline powered turtleneck sweater. And, of course, I bought some dumb stuff, too.” –Steve Martin

😉

Until next time!!

-Rae

Never miss a post…

Other posts I think you might like!

- Ibotta App Review – How to save money using this one simple app!

- How to set up a daily planner for success, and which planner is our absolute favorite for keeping an organized life!

What a excellent post on saving money. I actually learned something. Keep up the excellent work and thanks for sharing your ideas here!’

‘

Mark Jensen

Thank you Mark! I am so glad you learned something. 🙂

I read the 5 Love Languages, but did not know there was a version for children, so I’ll have to read it. And another way to save money, if you have not discovered it yet, are the ‘Buy Nothing’ groups in Facebook. Just find your local group and the possibilities are endless.

Yes, definitely read it, it is SO good! Oh that sounds amazing, I will definitely check it out! Thank you. 🙂

Dear Sarae

Thank you very much for your fantastic website. It is amazing that you show people where to start and what steps to make towards their dream-like family. I hope more people will know about your website and follow your guidance.

Kind regards,

Andrey

Thank you for your kind words, and thanks for stopping by! 🙂

Hi! This is really useful stuff!

I literally stopped in the middle of the article just to download the app.

Really, thank you for this post ^-^

Aw that’s so good!! You will love the ibotta app. I am obsessed… hahaha! Thank you for stopping by. 🙂

Hi Sarae, thanks for sharing so useful and thorough tips on how to be frugal and save some money after having the baby.

This will be very useful to me. My family’s finance is quite tight currently after we gave birth to our first baby. My wife quit the job and stay at home to care the baby. And i have huge amount housing loan to repay.. Be frugal and save some money means a lot to me. Thanks for your post, i learn something!

It is a hard time right after a baby comes and you suddenly move to one income. It can be very stressful and hard to adjust! But it is definitely possible. 🙂 It’s so great that your wife is able to stay home with the new little one, and congrats!!

Hey,

Excellent post and I love your website.

My best friends have just had a new baby and they would love your site. I have forwarded on this post for future reference for them and recommended that they bookmark your site and comment on your posts also with any questions that they have.

Well done on your posts and site, really is inspiring.

Thanks again and all the best,

Tom

Hi Tom! Thank you so much for your comment, and thank you so much for passing my site along to your friends. 🙂 I really appreciate it!

– Sarae

Good Use of Techniques in an Organic Life Enhancing Way.

Keep Up The Good Work 🙂

Thank you! 🙂

Hi, Rae, while I’m not a parent I have a lot of friends, both older and younger than me that are and many can benefit from your articles. With a lot of young parents, budgets can be tight, and the fact that you went out of your way to crunch numbers to over $1,300 in savings is enough to help exercise more financial freedom.

I also believe in the notion of telling kids no and DEFINITELY would limit eating out, as it should go without saying homecooked meals are far better nutritionally than anything from a restaurant. Myself, I only eat out once or twice a month, if that. Thanks for putting the time and work into this article so that all parents can find ways to save their hard earned cash while still providing the greatest possible life for their kids.

Thank you for the comment! Yes, it is so true that it is very difficult to eat healthy when you’re eating out. Especially with kids because they’re so picky! Sometimes a little more inconvenience is worth it to give your family a healthier lifestyle, and also be frugal with money.

Thanks for stopping by!

– Rae